The Moneysupermarket (LSE:MONY) share price could experience a significant rally soon, based on my analysis. This may come as a consequence of record revenues reported in its 2023 annual results released today.

Currently down almost 40% from their all-time high, where could the shares go from here?

A look at the results

Moneysupermarket, the financial services, consumer finance, and price comparison website, reported record-setting financial results for 2023.

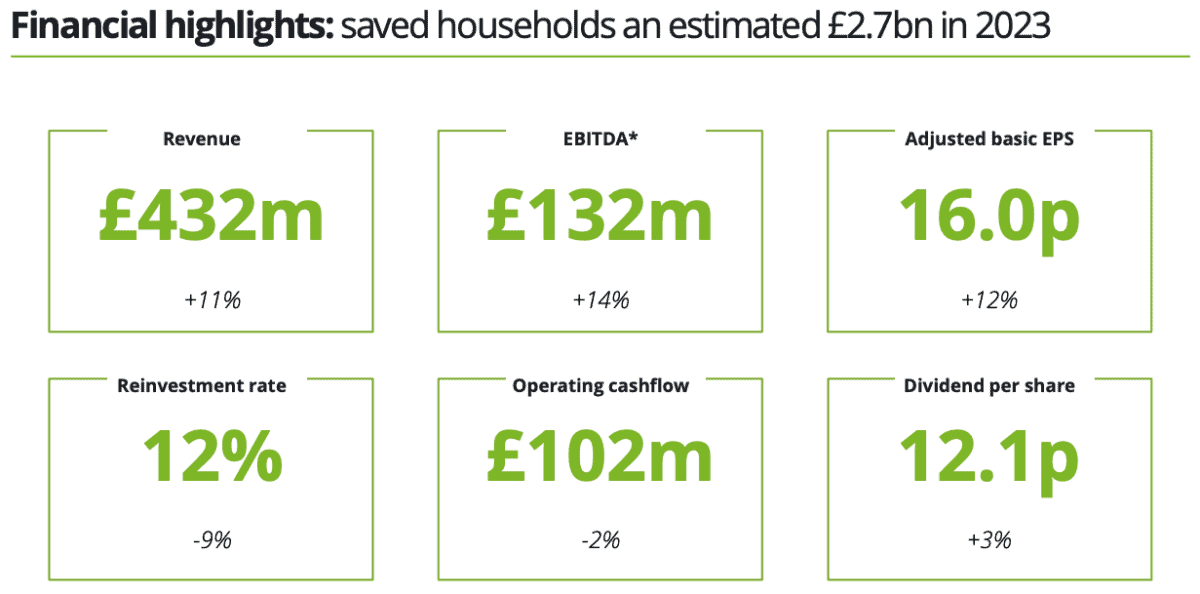

Notably, its revenue jumped 11% to £432m, its earnings per share jumped an even higher 12% to 16p, and its dividend per share climbed a healthy 3% to 12.1p.

The insurance segment stood out as the leader within the firm. That represented 51% of the group’s total revenue for the year. Insurance revenue rose 28%, reaching record highs, helped by its strong acquisitions in the area.

Additionally, the company reported an operating cash flow of £102.2m for the year, with a cash flow of £72.9m before paying £63.4m to shareholders.

The strength of operations is fully shown in its statement that it saved households an estimated £2.7bn in 2023.

How will the market react?

Today, the shares are down 1.7%. However, that’s short-term volatility, and it is difficult to correlate that exactly with the earnings results.

As a long-term investor, which is the Foolish way, I’m more interested in what the results could mean for the company over the next few years at least.

My research shows me this is a very strong business. For example, I consider its net margin of 18.5% industry-leading. Additionally, its balance sheet has a reasonable 52% of assets balanced by debts.

Also, with a price-to-earnings ratio of just 14, based on future income estimates, I think the 2023 results have positioned Moneysupermarket shares to have an excellent year ahead.

The risks

Of course, any investment comes with a set of risks, and Moneysupermarket has its fair share.

The financial results for 2023 revealed a 9% reduction in its reinvestment rate, now at 12%. This means the firm is less focused on reinvesting earnings to grow the business at this time. Also, I’ve made note that the company’s full-year operating cash flow I mentioned above is a 2% reduction on the last report.

Furthermore, my research on its recent historical financials has proven this has been a low-growth enterprise. It actually saw its revenues decrease on average by 0.2% per year for the past three years.

Obviously, 2023’s results provide some consolation, but still, I feel I would need to keep my wits about me if I made an investment.

Watchlist material

Moneysupermarket’s 2023 results are resoundingly positive, and with a share price that looks moderately undervalued to me at this time, I see a strong future for the investment.

However, I’m not convinced it is the best place to park my cash right now when compared to the other businesses in my portfolio. So, while I’m keeping an eye on it, I won’t be purchasing a stake in the company at this time.